February 2021 Global Results

Executive Confidence Levels in Key Industries over the 11 Months of the Pandemic

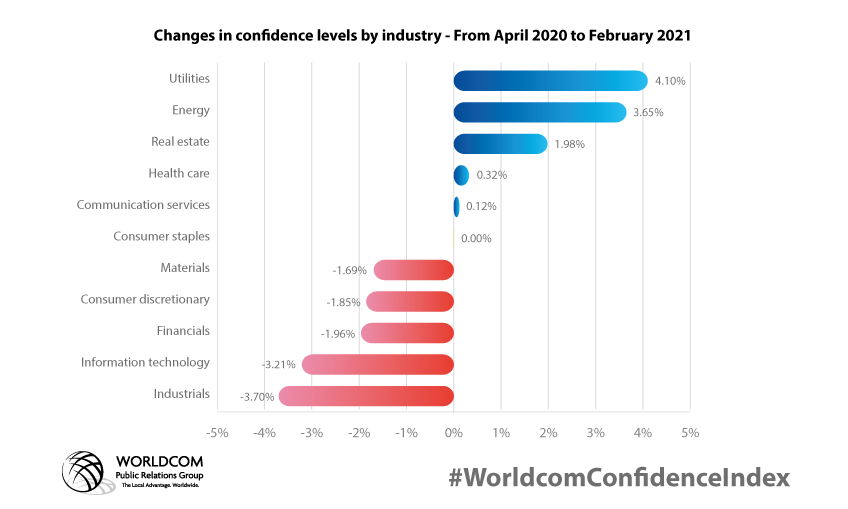

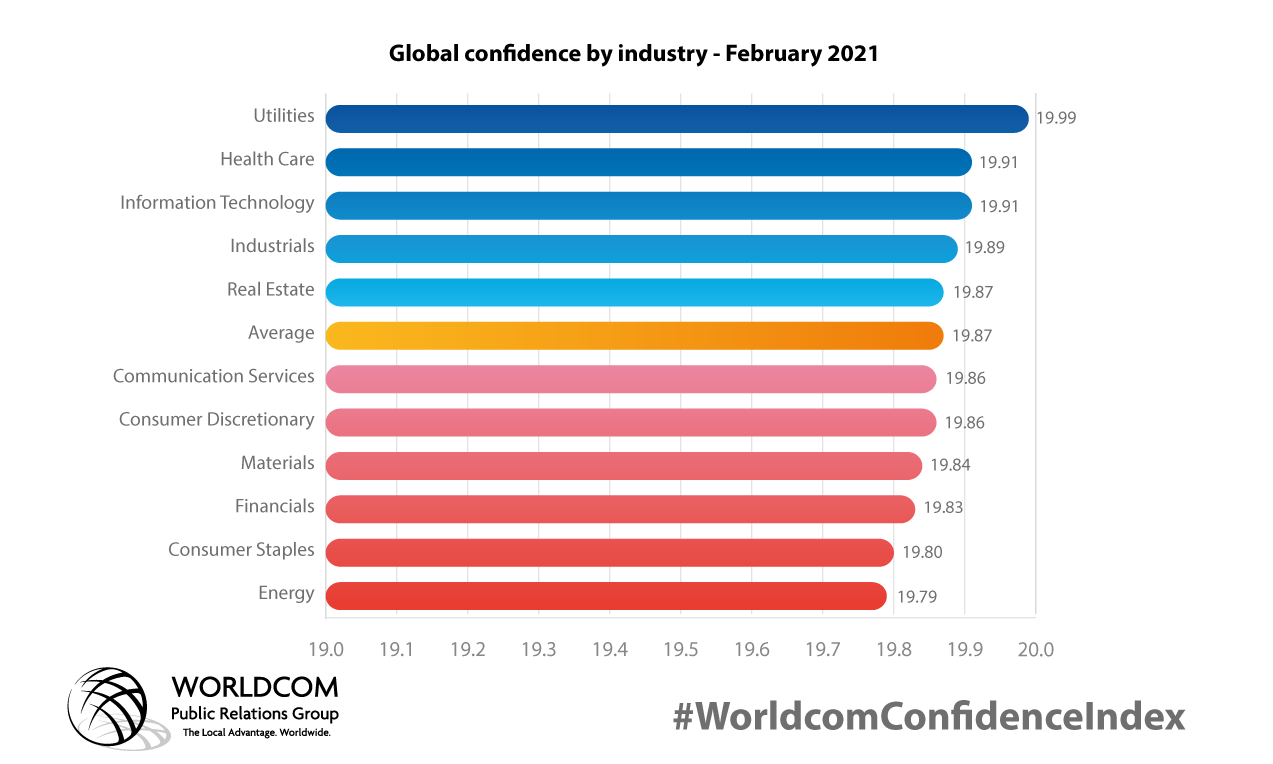

The WCI monitors the levels of engagement with business topics by over 54,000 CEOs/CMOs globally and measures their confidence and concern with each of these topics. This month’s report examines executive confidence level in 11 key industries. CEOs and CMOs in the energy sector remain the least confident despite the second largest rise in confidence since April 2020. Leaders in the utilities, healthcare, IT, industrial, and real estate sectors have above-average confidence.

*The Worldcom Confidence Index (WCI) is a living study that uses a breakthrough approach powered by artificial intelligence (AI), which allows us to discover the issues that concern leaders globally – and their confidence levels in addressing them. Topics and sentiments are drawn from online conversations of over 54,000 CEOs and CMOs around the world.

Consumer Staples second least confident sector

Consumer Staples is the second least confident sector because of concerns over global supplies and the increasing need to source locally. Leaders in the Consumer Discretionary sector are more confident, although also with below-average confidence.

Information Technology a mixed picture

Confidence for leaders in the Information Technology (IT) sector remains above average but saw the second largest decline since April 2020 – down 3.2% .

The IT sector has the lowest confidence score for six topics: The influence on success of financial/economic factors; Competition influences success; Crisis management; Customer satisfaction; Employee engagement to improve productivity and somewhat ironically, the use of technology to collaborate and innovate.

Utilities tops the Index and sees biggest confidence increase since April 2020

Leaders in the utilities sector are most confident. And their confidence increased the most from April 2020 – up 4.1%. This indicates that this will be a high-profile topic for business leaders in the months to come, so it’s not surprising that sustainability issues are the number two issue for CEOs and CMOs at utilities.

Healthcare leaders have lowest confidence for data privacy and protection and retaining talent

Healthcare leaders are the second most confident of the 11 sectors reviewed. But they are least confident for four topics, including data privacy and protection and retaining talent. Worldcom’s Healthcare Monitor, published in April, also highlighted that pharma companies are not optimizing online and social media communications to their advantage.

Upskilling and reskilling is the #1 topic for leader engagement across all sectors

Upskilling and reskilling is the number one topic for leader engagement across all sectors and retaining talent is the #2 topic for all sectors except utilities, where the #2 issue is reducing plastics and other sustainability issues. This shows that leaders recognize that they will need to develop a culture that engages and inspires employees.

African leaders most confident for three sectors and least confident in four

- Confidence for leaders in Africa varies significantly by sector. African leaders are the most confident globally for consumer staples, financials, and industrials and least confident for consumer discretionary, energy, materials, and utilities.

- North American leaders are most confident globally for four sectors: healthcare, IT, real estate, and utilities.

- Asian leaders are most confident for three: communication services, consumer discretionary, and materials.

- Like their African peers, European leaders have mixed confidence levels, being most confident globally for energy and least confident for financials and industrials.

- Leaders in LATAM are least confident for five industries: communication services, consumer staples, healthcare, IT, and real estate.

Artificial Intelligence provides unrivalled view of trending topics and leaders’ confidence and concern in addressing them

The Worldcom Confidence Index is able to operate at this scale, and in nine different languages, because the data is captured using a breakthrough approach powered by artificial intelligence (AI). This allows us to discover the issues that concern leaders – and their confidence levels in addressing them. The chosen research firm, Advanced Symbolics Inc. (ASI), has developed a patented method of building representative samples and then capturing information with their AI tool. By using ASI’s AI tool, we have produced a truly global perspective on the business issues of the moment and where they rank in terms of leadership attention. We’ve also calculated the confidence index level for every topic and audience and identified how this changes for 42 countries around the world. This is incredibly valuable insight because it not only represents what leaders are talking about, rather than responses to questions, but also shows their confidence or concern in addressing each topic. It means you can compare your own thoughts with more than 54,000 of your global peers.