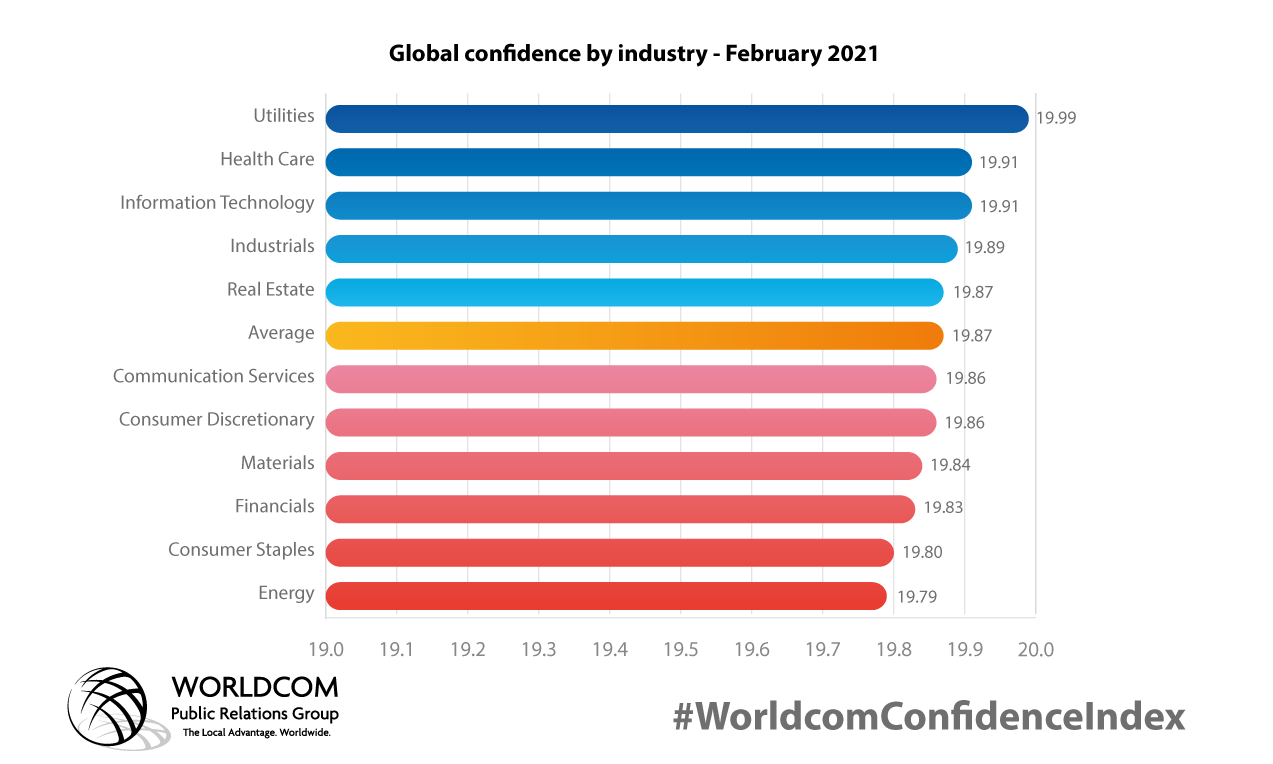

NEW YORK (April 29, 2020) – Worldcom released its latest Worldcom Confidence Index (WCI) report, which focuses on 11 industry sectors. The WCI monitors the levels of engagement with business topics by over 54,000 CEOs/CMOs globally and measures their confidence and concern with each of these topics. This month’s report examines executive confidence level in 11 key industries. CEOs and CMOs in the energy sector remain the least confident despite the second largest rise in confidence since April 2020. Leaders in the utilities, healthcare, IT, industrial, and real estate sectors have above-average confidence[i].

Consumer Staples second least confident sector

Consumer Staples is the second least confident sector because of concerns over global supplies and the increasing need to source locally. It may also be a result of concerns over employee burnout, as this sector has operated continuously through the various lockdowns of the last 12 months. Employees have often been confronted by higher-risk working conditions and violent or abusive consumer behavior.

Leaders in the Consumer Discretionary sector are more confident, although also with below-average confidence. This disparity is perhaps because there are winners and losers in different areas of this sector. In-home entertainment and home improvements have done very well, as have retailers with a robust online presence. But other discretionary products with a traditional bricks-and-mortar approach have struggled for obvious reasons.

Information Technology a mixed picture

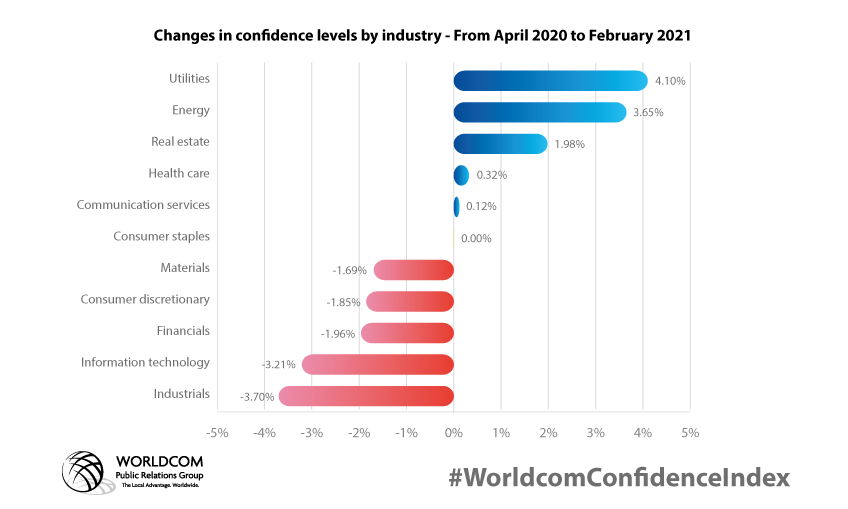

Confidence for leaders in the Information Technology (IT) sector remains above average but saw the second largest decline since April 2020 – down 3.2%[ii]. IT products and services focused on communication and collaboration such as Zoom have been much in demand. Other products like Bridge online learning and performance management, which are optimized to assist the new style of hybrid working, are also performing strongly.

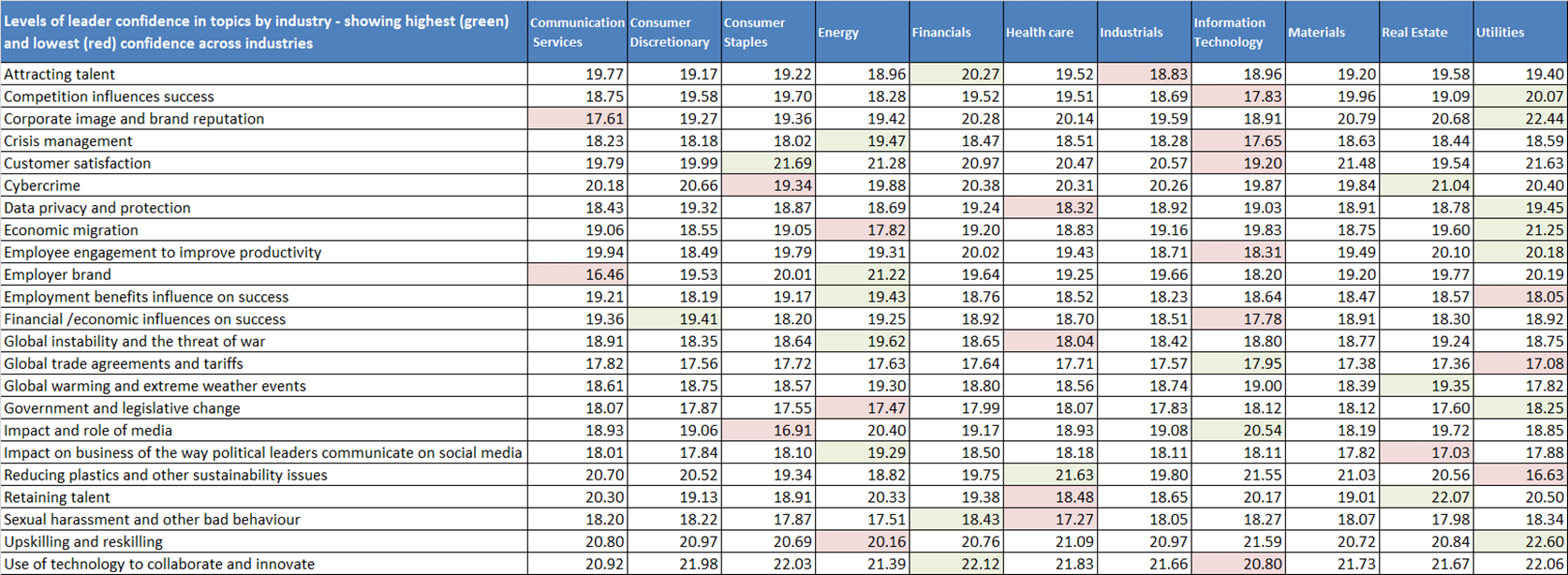

However, the decline in confidence is perhaps a recognition that the uplift caused by the pandemic may be followed by a decrease in demand as the recessionary impact of the pandemic starts to take its toll. The IT sector has the lowest confidence score for six topics: The influence on success of financial/economic factors; Competition influences success; Crisis management; Customer satisfaction; Employee engagement to improve productivity and somewhat ironically, the use of technology to collaborate and innovate[iii]. Perhaps that is why Microsoft has been investing in a brand-building advertising campaign around the business outcomes delivered by Microsoft Teams to build brand loyalty.

Roger Hurni, Chair of The Worldcom Public Relations Group, said: “The varying confidence across sectors highlights the different communications challenges and opportunities faced by leaders in each sector. There is one key takeaway, organizational culture, and how upskilling is embedded in that culture, will be vital to future success.”

Utilities tops the Index and sees biggest confidence increase since April 2020

Leaders in the Utilities sector are most confident. And their confidence increased the most from April 2020 – up 4.1%. This uptick could be a reaction to the new stance on climate change adopted by the Biden administration in the US, which saw China and the US pledge a new commitment to carbon reduction in April. The UK’s decision to slash carbon emissions by 78% by 2035 indicates that this will be a high-profile topic for business leaders in the months to come, so it’s not surprising that sustainability issues are the number two issue for CEOs and CMOs at utilities.

Healthcare leaders have lowest confidence for data privacy and protection and retaining talent

Healthcare leaders are the second most confident of the 11 sectors reviewed. But they are least confident for four topics, including data privacy and protection and retaining talent. Worldcom’s Healthcare Monitor, published in April, also highlighted that pharma companies are not optimizing online and social media communications to their advantage.

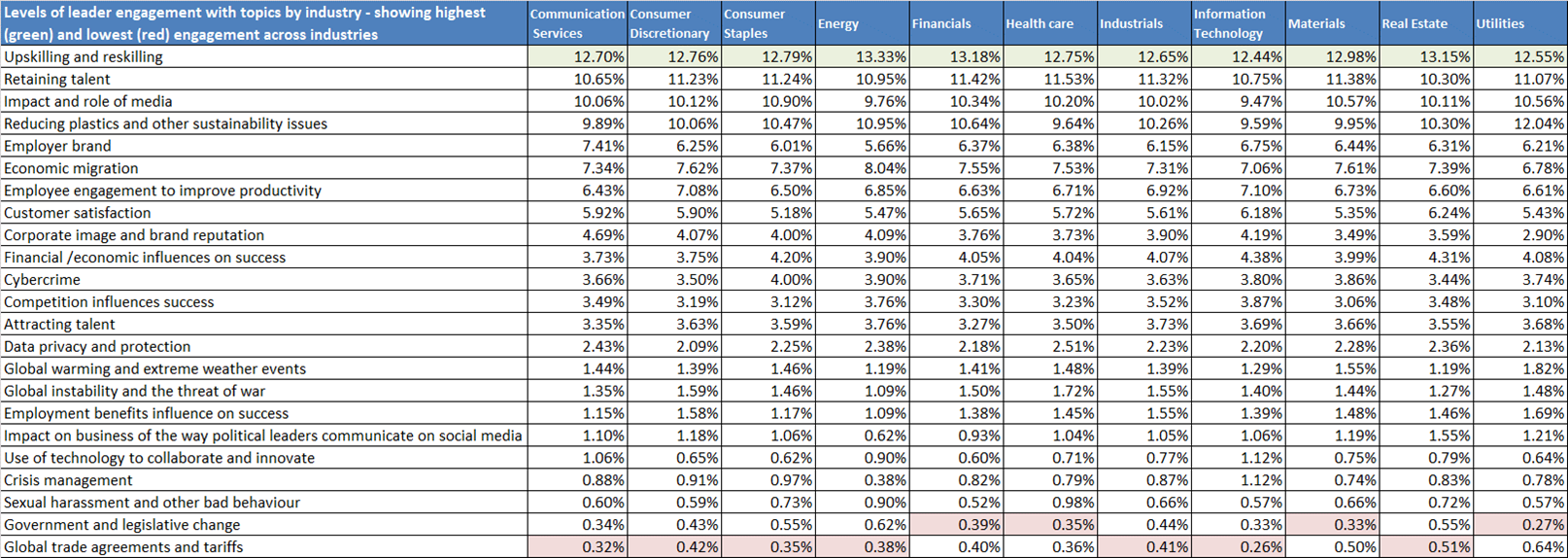

Upskilling and reskilling is the #1 topic for leader engagement across all sectors

Upskilling and reskilling is the number one topic for leader engagement across all sectors and retaining talent is the #2 topic for all sectors except utilities. For the utilities sector, the #2 issue is reducing plastics and other sustainability issues[iv]. This focus on upskilling shows that leaders recognize that they will need to develop a culture that engages and inspires employees. This movement was reinforced at the global Inspirathon – which featured a number of sessions on culture, including The 3 Key Elements to Creating An Amazing Company Culture by Karin Volo and Building a world-class remote culture by Robert Glazer.

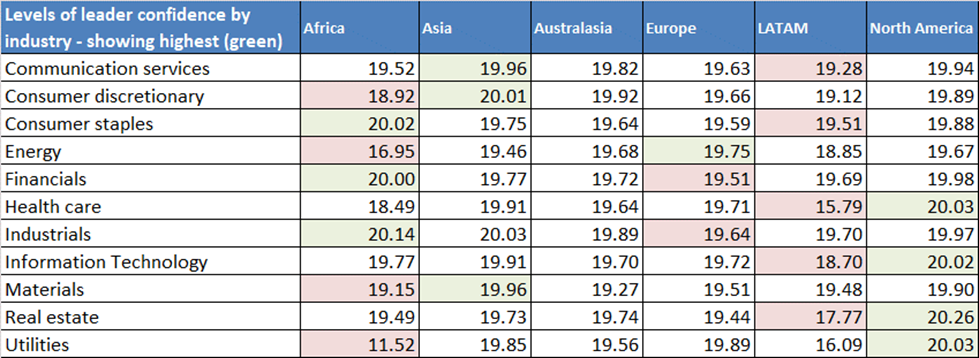

African leaders most confident for three sectors and least confident in four

Confidence for leaders in Africa varies significantly by sector. African leaders are the most confident globally for consumer staples, financials, and industrials. They are least confident for consumer discretionary, energy, materials, and utilities[v].

- North American leaders are most confident globally for four sectors: healthcare, IT, real estate, and utilities.

- Asian leaders are most confident for three: communication services, consumer discretionary, and materials.

- Like their African peers, European leaders have mixed confidence levels, being most confident globally for energy and least confident for financials and industrials.

- Leaders in LATAM are least confident for five industries: communication services, consumer staples, healthcare, IT, and real estate.

Todd Lynch, Managing Director of The Worldcom Public Relations Group, said: “The results in this report cover 11 months of the pandemic. The changes in confidence show how the constantly shifting landscape caused by the pandemic requires very flexible communication strategies. We will continue to monitor levels of topic engagement and confidence to provide the critical insight organizations need to navigate an uncertain future.”

Methodology

The Worldcom Confidence Index (WCI) is a living study that uses a breakthrough approach powered by artificial intelligence (AI), which allows us to discover the issues that concern leaders globally – and their confidence levels in addressing them. Topics and sentiments are drawn from online conversations of over 54,000 CEOs and CMOs around the world, in nine different languages. The chosen research firm, Advanced Symbolics Inc (ASI), has developed a patented method of building representative samples and then capturing information with their AI tool.

About The Worldcom Public Relations Group

The Worldcom Public Relations Group (Worldcom) is the world’s leading partnership of independently owned public relations firms, with 143 offices employing some 2,000 staff in 115 cities across six continents. In total, Worldcom partners reported a combined revenue of U.S. $300+ million last year from 3,034 clients. Established in 1988, the group was formed so that the strongest, most capable independent firms could inspire direct action from stakeholders in a way that delivers immediate results and lasting outcomes– wherever in the world a client needs support.

Worldcom’s partners deliver unique connectivity to their marketplace. This provides clients direct access to the audiences they most want to take action and to specialists that can deliver on challenging problems. As a result, strategies and campaigns see immediate reactions that turn into sustained audience actions. Partners serve national, international, and multinational clients while retaining the flexibility and client-service focus inherent in independent agencies. Through Worldcom, clients have on-demand access to in-depth communications expertise from professionals who understand the language, culture, and customs of the geographic areas in which they operate. Learn more about Worldcom at www.worldcomgroup.com or by calling 1-800-955-9675.

Connect with The Worldcom PR Group on Facebook and LinkedIn.

# # #

Contact: Todd Lynch, (904) 233-0123, [email protected] for a global view