August 2020 Global Results

The Worldcom Confidence Index (WCI) is a living study that uses a breakthrough approach powered by artificial intelligence (AI), which allows us to discover the issues that concern leaders globally – and their confidence levels in addressing them. Topics and sentiments are drawn from online conversations of over 54,000 CEOs and CMOs around the world.

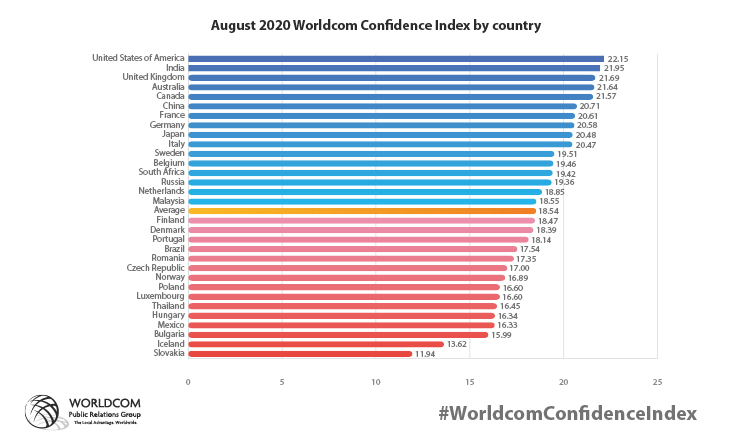

The August update to leaders confidence and concerns draws upon content created by CEOs and CMOs from all around the world. A detailed picture is now available for 31 countries from Thailand to Russia and Belgium to Canada. This is a further proof of Worldcom’s desire to provide global, regional, and local insight that assists decision-making by business leaders.

Each month, the WCI provides a ‘moving window’ view on the issues that are uppermost in CEOs/CMOs minds as they respond to the rapidly changing landscape of the COVID-19 pandemic and navigate other significant business challenges.

The Worldcom Confidence Index (WCI) 10

The Worldcom Confidence Index highlights CEO/CMO confidence and concerns across 23 topics and six audiences. We have outlined the top 10 findings for August in what we call “The Worldcom Confidence Index 10.” The August WCI 10 shows the main five changes in global confidence since July 2020, and the main five trends across 11 business sectors from communications services to utilities.

Download the August 2020 Worldcom Confidence Index 10

View More Worldcom Confidence Index Videos

GLOBAL TRENDS

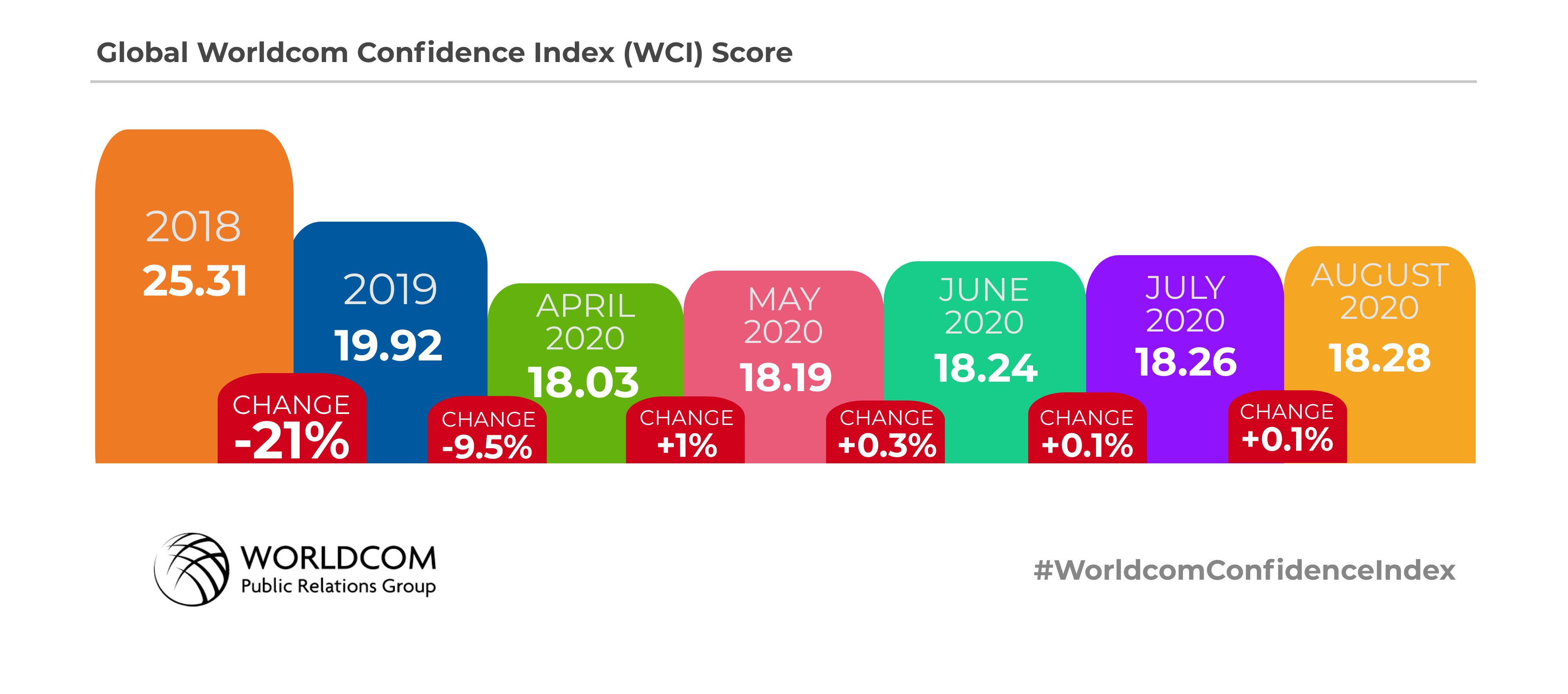

1. The gentle upward trend in global confidence continued in August

Worldcom Confidence Index (WCI) monthly report for August 2020 shows that as it has become clear that the world will need to live alongside COVID-19 until at least the middle of 2021, leaders are clearly trying to be positive as they focus on the areas that matter to their survival/recovery.

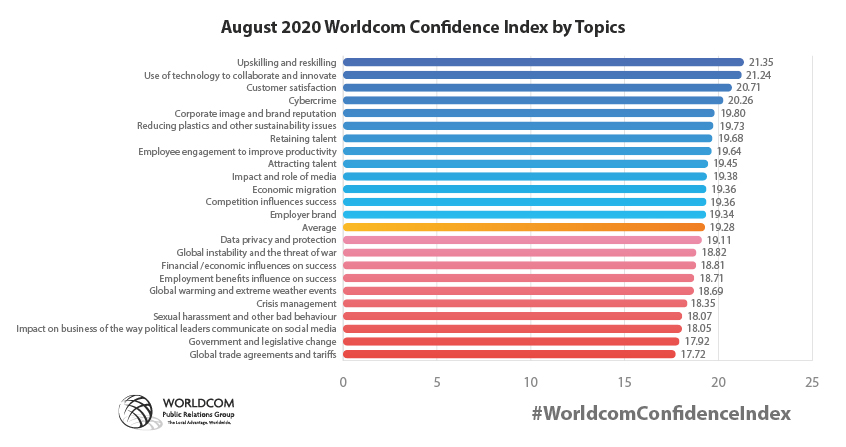

2. The main topics of focus remained unchanged since July. The top 10 topics are solidifying as the ones leaders think are key to the recovery

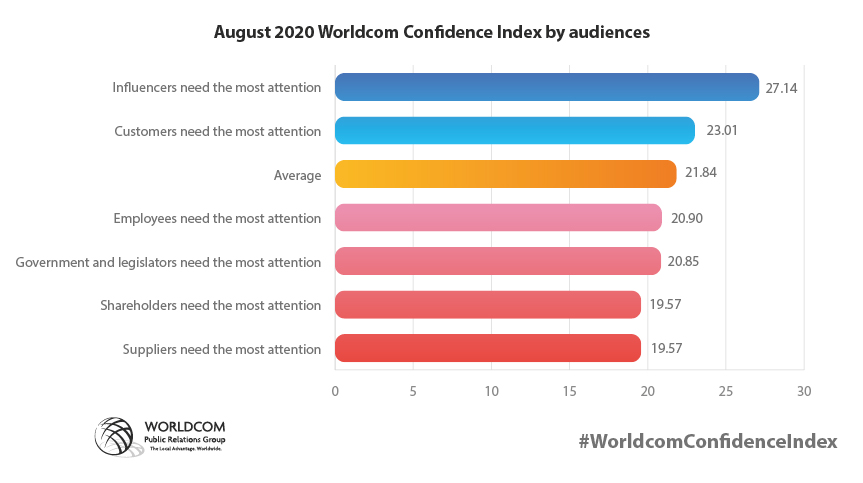

Employee-related topics represented 5 of top 7 topics for CEOs and CMOs. Upskilling and reskilling retained the highest engagement level, closely followed by retaining talent. Organisations need to communicate clearly what they will do to ensure that employees have the skills needed to succeed in a changed world.

• Employees with the right skills are seen as most important to the recovery

While employees with the right skills are seen as most important to the recovery – the confidence of business leaders in dealing with employees was below average for audiences.

• Leaders also see the media and how they influence success as important

This topic featured at #3 for leader engagement in August.

• Sustainability issues remained at #4 for leader engagement

Organisations will need to communicate how they are addressing sustainability issues if they want to protect and enhance their reputation.

• Satisfying customers was the fourth area of focus

This topic featured at #8 for leader engagement. Staying in tune with changed customer expectations will be vital to success. The WCI sector data below provides an insight into how priorities change by sector.

• Corporate image and brand reputation featured at #9 for leader engagement

This shows that the reputational issues relating to employees, the media, sustainability and customers is high on leaders’ agenda.

• Financial and economic influences rounded out the areas of most importance

This topic featured at #10 for leader engagement in August.

3. The top five areas of concern remained the same since July

These were – in increasing levels of concern – crisis management, sexual harassment and other bad behavior, the impact of the way political leaders communicate on social media, government and legislative change and global trade agreements and tariffs.

4. Worldcom Confidence Index data is now available for Thailand

It appeared at #26 on the country confidence table. Thailand came last in the WCI for three topics: the influence of competition on success, data privacy and protection, and attracting talent.

5. Three countries took the #1 position for confidence for 19 of the 23 topics

France for 10, U.K. for five and Japan for four topics. Five countries took the last position for confidence for 16 topics: Bulgaria for four, Iceland, Slovakia, Thailand and Russia for three topics each.

INDUSTRY SECTOR TRENDS

This month we have identified the main trends across 11 business sectors from communications services to utilities.

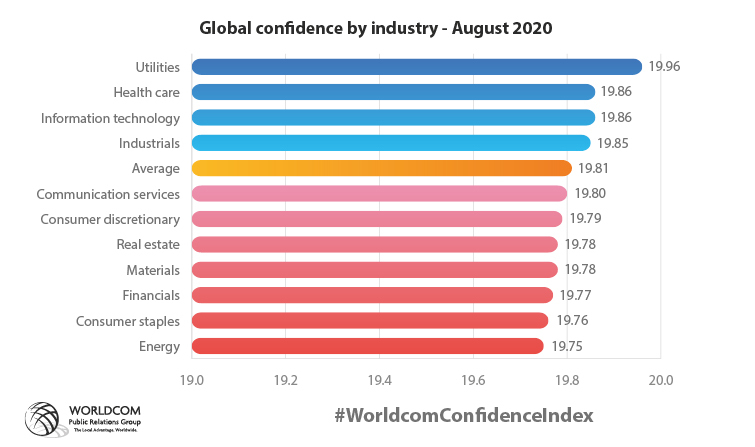

1. Leaders in the Utilities, Healthcare, IT and Industrial sectors had above average confidence

Confidence Index (WCI) monthly report for August 2020 included results for 11 industry sectors. Leaders in the utilities, healthcare, IT and industrial sectors had above average confidence.

2. Energy sector ranked at the bottom of the WCI

Leaders in the energy sector, which has been significantly impacted by the COVID-19 pandemic, had the lowest confidence level. CMOs in the energy sector had the lowest confidence level of all sectors. This possibly points to the reputational challenges faced by this sector around sustainability issues which was the fifth highest topic of concern for leaders in this sector.

3. The regional confidence and concern levels highlighted the different reactions to the pandemic around the world

- Leaders in North America were more confident than their peers in six sectors (Energy, Healthcare, Information technology, Materials, Real estate, Utilities).

- Leaders in Africa were more confident than their peers in three sectors (Consumer staples, Financials, Industrials).

- Leaders in Asia were more confident than their peers in two sectors (Communications services, Consumer discretionary).

- Leaders in Europe were more confident than their peers in only one sector (Energy). The same score as North America.

- Leaders in LATAM were more concerned than their peers in five sectors (Consumer Staples, Healthcare, Industrials, Information Technology, Real estate).

- Leaders in Africa were more concerned than their peers in five sectors (Communications services, Consumer discretionary, Energy, Materials, Utilities).

- Leaders in Europe were more concerned than their peers in one sector (Financials).

4. IT was the most confident sector in 12 of the 31 countries featured

Industrials was the most confident sector in eight countries. Energy was the least confident sector in nine countries, real estate was least confident in six countries, and utilities was least confident in five countries.

5. The confidence in topics in each sector shows some interesting sectoral differences

- Leaders in the communications services sector were most confident about their ability to upskill and reskill employees, but most concerned about their employer brand and general brand reputation.

- Leaders in the consumer staples sector were most confident about customer satisfaction, but most concerned about the impact and role of the media.

- Leaders in the healthcare sector were most confident about the use of technology to collaborate and innovate. The COVID-19 pandemic has seen this sector lean heavily on technology to meet new needs. Leaders in this sector were most concerned about sexual harassment and other bad behavior.

- Leaders in the IT sector were most confident about upskilling and reskilling, and most concerned about crisis management.

- Leaders in the real estate sector were most confident about retaining talent, and most concerned about the way political leaders communicate on social media.

- Leaders in utilities were most confident about upskilling and reskilling, and most concerned about reducing plastics and other sustainability issues.

Artificial Intelligence provides unrivalled view of trending topics and leaders’ confidence and concern in addressing them

As for the 2019 Worldcom Confidence Index, the study was able to operate at this scale, and in nine different languages, because the data was captured using a breakthrough approach powered by artificial intelligence (AI), which allowed us to discover the issues that concern leaders – and their confidence levels in addressing them. The chosen research firm, Advanced Symbolics Inc. (ASI), has developed a patented method of building representative samples and then capturing information with their AI tool. By using ASI’s AI tool, we have produced a truly global perspective on the business issues of the moment and where they rank in terms of leadership attention. We’ve also calculated the confidence index level for every topic and audience and identified how this changes around the world. This is incredibly valuable insight because it not only represents what leaders are talking about, rather than responses to questions, but also shows their confidence or concern in addressing each topic. It means you can compare your own thoughts with more than 54,000 of your global peers.